Payers of insurance premiums have the right to a timely offset or refund of amounts of overpaid or overcharged insurance premiums, penalties and fines.

If a fact of excessive payment of insurance premiums is detected, the territorial body of the Pension Fund of the Russian Federation informs the payer about this within 10 days from the date of discovery of the fact of overpayment.

If a possible overpayment is detected, the territorial body of the Pension Fund has the right to conduct a joint reconciliation of calculations for accrued and paid insurance premiums with the payer. The results of such reconciliation are documented in an act signed by both parties.

The amount of overpaid insurance premiums may be:

- offset against future payments of the payer;

- offset against debt repayment of penalties and fines for offenses;

- returned to the insurance premium payer.

Set-off of the amount of overpaid insurance premiums towards upcoming payments the payer of insurance premiums is carried out by decision of the body monitoring the payment of insurance premiums independently. This does not prevent the payer of insurance premiums from submitting to the body monitoring the payment of insurance premiums an application submitted to writing or in the form of an electronic document on the offset of the amount of overpaid insurance premiums.

The territorial body of the Pension Fund makes the corresponding decision within 10 days from the date it discovers the fact of overpayment, or from the day it receives an application from the payer of insurance premiums, or from the date of signing the act of joint reconciliation of paid insurance premiums (if such a reconciliation was carried out).

Offsetting the amount of overpaid insurance contributions to pay off debts on penalties and fines territorial bodies PFR is carried out independently. In this case, the decision is made within 10 days from the date of discovery of the fact of excessive payment of insurance premiums, or from the date of signing the act of joint reconciliation of paid insurance premiums, or from the date of entry into force of the court decision. However, the payer himself can submit an application so that the amount he has paid in excess will be counted against the debt on penalties and fines. In this case, the decision is also made within 10 days.

Since 2015, the offset of overpaid amounts of insurance premiums for one type of insurance, administered by one body for control over the payment of insurance premiums, against the upcoming payments of the payer of insurance premiums, payments to repay arrears on insurance premiums and debts on penalties and fines for another type of insurance, administered the same body for control over the payment of insurance premiums is carried out upon application payer of insurance premiums, submitted in writing or in the form of an electronic document

Thus, overpayments of compulsory health insurance contributions can be offset against pension contributions and vice versa. But the overpayment of these contributions cannot be used to pay off debts on contributions to the social insurance fund, since control over the correctness of their payment is entrusted to the Social Insurance Fund.

To return overpaid insurance premiums, the payer must submit an application, and then the amount will be returned within a month after receiving such an application. If the payer has arrears of penalties and fines, the refund is made only after the amount of overpaid insurance premiums is offset against the debt. An application for offset or refund of the amount of overpaid insurance premiums may be submitted within three years from the date of payment of the specified amount.

Pension Fund Russian Federation within five days from the date of the decision, he is obliged to notify the insurance premium payer in writing or in the form of an electronic document about the decision taken on the offset (refund) of the amounts of overpaid insurance premiums or on the refusal to carry out the offset (refund). The specified message is transmitted to the head of the organization, an individual, or their representatives personally against a signature or in another way confirming the fact and date of its receipt. If the specified message is sent by registered mail, it is considered received after six days from the date of sending the registered letter.

IMPORTANT! A refund of the amount of overpaid insurance contributions to the Pension Fund is not made if the territorial body of the Pension Fund took into account the amount of overpaid insurance contributions as part of the personalized accounting information and this information was posted by the Fund to the individual personal accounts of the insured persons.

- Form 22-PFR - application for offset of overpaid insurance premiums, penalties and fines, Appendix No. 2 to the resolution of the Board of the Pension Fund of December 22, 2015 No. 511p

- Form 23-PFR - application for the return of overpaid insurance premiums, penalties and fines, Appendix No. 3 to the Resolution of the Board of the Pension Fund of December 22, 2015 No. 511p

Employers who pay insurance premiums during the billing period at the end of each calendar month are required to calculate and pay insurance premiums to state extra-budgetary funds. These are determined in the form of a difference, with:

The deductible is the product of the base for calculating insurance premiums from the beginning of the billing period to the end of the corresponding calendar month and the tariffs of insurance premiums;

- deductible - the amount of insurance premiums calculated from the beginning of the billing period to the previous calendar month inclusive.

During the billing period, the policyholder pays insurance premiums in the form of monthly mandatory payments. They must be transferred no later than the 15th day of the calendar month following the calendar month for which the monthly obligatory payment is calculated (clauses 1, 3, article 431 of the Tax Code of the Russian Federation, clauses 3, 4, 5, article 15 Federal Law dated July 24, 2009 N 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund” (hereinafter referred to as Law N 212-FZ)).

Overpayment concept

Sometimes the payer transfers amounts to the treasury that are slightly larger than expected. The reasons may be different:

- banal inattention when filling out the appropriate payment form;

- failure to take into account the existing maximum base values for calculating insurance contributions for compulsory pension insurance and compulsory social insurance in case of temporary disability and in connection with maternity (hereinafter referred to as VNiM insurance);

- calculation of insurance premiums for amounts from which contributions are not calculated, etc.

At PBOYULov on common system taxation, paying contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund in fixed amounts, whose income in 2014 and 2015 exceeded 300,000 rubles, the overpayment of “pension” insurance contributions for these years arose after the publication of the resolution Constitutional Court RF dated November 30, 2016 N 27-P. The Constitutional Court of the Russian Federation considered that the indication in paragraph 1 of part 8 of Article 14 of Law N 212-FZ on the need to account for income in accordance with Article 227 of the Tax Code of the Russian Federation, which can only be applied in systematic connection with paragraph 1 of Article 221 of the Tax Code of the Russian Federation, indicates the intention of the legislator to determine for the purpose of establishing the amount of insurance premiums, the income of an entrepreneur who pays personal income tax and does not make payments to individuals, as gross income minus documented expenses directly related to the extraction of income.

The Pension Fund of the Russian Federation, at the request of the Ministry of Labor (letters dated November 16, 2016 N 17-4/ОOG-1563, dated July 9, 2014 N 17-3/В-313) recommended that entrepreneurs calculate “pension” insurance contributions from the amount of income they actually received from the implementation of entrepreneurial activity for this billing period, without taking into account tax deductions, provided for by Chapter 23 of the Tax Code of the Russian Federation.

Pensioners also sent letter from the Ministry of Labor of Russia N 17-3/B-313 to the Federal Tax Service, since tax authorities are entrusted with the obligation to submit information on income from activities to the Pension Fund of Russia individual entrepreneurs for the billing period (clause 9 of article 14 of Law No. 212-FZ).

Overpayment of insurance premiums may also arise if the court finds the actions of the supervisory authority regarding the collected amounts of insurance premiums (penalties, fines) to be unlawful.

When introducing Chapter 34 “Insurance premiums” into the Tax Code of the Russian Federation, the legislator did not decipher the concept of “overpaid (collected) insurance premiums”. There is also no concept of “excessively paid (collected) tax” in the Tax Code of the Russian Federation. But the Code regulates the procedures for offset or return of amounts of overpaid (collected) taxes, fees, insurance premiums, penalties and fines (Articles 78, 79 of the Tax Code of the Russian Federation).

The Presidium of the Supreme Arbitration Court of the Russian Federation considered that excessive payment of tax occurs when the taxpayer, calculating the amount of tax payable to the budget independently (without the participation of the tax authority), for any reason (including due to ignorance of tax legislation or an honest mistake) makes a mistake in calculations. An overpaid amount of tax may be recognized as being credited to the accounts of the corresponding budget. Money in an amount exceeding the tax amounts payable for certain tax periods (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 27, 2011 N 2105/11).

The taxpayer’s right to offset and return from the relevant budget overpaid or collected tax amounts is directly related to the presence of overpayment of tax amounts to this budget and the absence of debt on taxes credited to the same budget, which is confirmed by certain evidence:

- payment orders of the taxpayer;

- collection orders (instructions) of the tax authority;

- information about the taxpayer’s fulfillment of the obligation to pay taxes, contained in the database formed for each taxpayer by the tax authority, characterizing the state of his settlements with the budget for taxes and reflecting operations related to the accrual, receipt of payments, offset or refund of tax amounts.

The presence of an overpayment is revealed by comparing the tax amounts payable for a certain tax period with payment documents relating to the same period, taking into account information about the taxpayer’s settlements with budgets (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated February 28, 2006 N 11074/05).

In other words, an amount mistakenly transferred (collected) to the budget of a state extra-budgetary fund as insurance premiums can be considered overpaid (collected) insurance premiums only when the funds actually entered the corresponding budget. Moreover, overpaid (collected) insurance premiums are amounts received into the corresponding budget, regardless of the time they were credited - before January 1, 2017 or after.

As you know, 0 hours on January 1, 2017 for insurance premiums is a milestone:

- before that, the calculation procedure was determined by the aforementioned Law No. 212-FZ and they were administered by the Pension Fund of Russia and the Federal Social Insurance Fund of Russia (clause 1 of Article 3 of Law No. 212-FZ);

- after that, the procedure for calculating insurance premiums is regulated by Chapter 34 of the Tax Code of the Russian Federation, and control functions were transferred to the Federal Tax Service of Russia (subclauses 3 - 5, clause 1, article 23, clause 2.1, article 31, clause 1, article 82 of the Tax Code of the Russian Federation).

Since January 1, 2017, the powers of budget revenue administrators have been delineated between the tax authorities and the authorities of state extra-budgetary funds of the Russian Federation in terms of:

- control over the correctness of calculation, completeness and timeliness of payment (transfer) of these insurance premiums;

- checking calculations (updated calculations) submitted for reporting (settlement) periods for insurance premiums that expired before January 1, 2017;

- collection of arrears on the specified insurance premiums, debt on relevant penalties and fines, as well as

- making decisions on the return of amounts of overpaid (collected) insurance premiums, penalties and fines for reporting (calculation) periods that expired before January 1, 2017.

The Pension Fund of Russia and the Federal Insurance Fund of Russia control the correctness of calculation, completeness and timeliness of payment (transfer) of insurance premiums payable for reporting (calculation) periods expired before January 1, 2017 (Article 20 of the Federal Law of July 3, 2016 N 250-FZ, hereinafter - Law N 250-FZ). These functions are carried out in the manner established by Law No. 212-FZ.

Tax authorities have the right to collect:

- arrears on insurance premiums, corresponding penalties and fines to state extra-budgetary funds formed as of January 1, 2017;

- insurance premiums, penalties and fines additionally accrued by the Pension Fund of the Russian Federation and the Social Insurance Fund based on the results of control measures carried out for settlement (reporting) periods that expired before January 1, 2017, for which there are decisions on bringing to liability (refusal to bring to liability) that have entered into force ) (Clause 2, Article 4 of Federal Law No. 243-FZ of July 3, 2016 (hereinafter referred to as Law No. 243-FZ)).

Tax authorities carry out collections in the manner and within the time limits established by the Tax Code of the Russian Federation, starting with the collection measure following the measure applied by the Pension Fund of Russia and the Social Insurance Fund of Russia.

The payer can justify the formation of an overpaid amount of insurance premiums by submitting an updated calculation of insurance premiums.

Updated calculations of insurance premiums for reporting (settlement) periods that expired before January 1, 2017 (Form RSV-1 PFR, Form 4 - FSS) must be submitted to the territorial offices of the Pension Fund of the Russian Federation or the FSS of Russia in the manner established by Law N 212-FZ ( Article 23 of Law No. 250-FZ).

Insurance premiums, which were established by Law N 212-FZ, in their social nature and purpose do not differ from the insurance premiums established by the Tax Code of the Russian Federation, but they are not subject to regulation by the Tax Code of the Russian Federation. Therefore, amounts of overpaid or collected insurance premiums generated during the period up to December 31, 2016 inclusive cannot be offset against insurance premiums calculated from the beginning of the current year. Laws No. 243-FZ and 250-FZ do not provide for the offset of amounts of overpaid (collected) insurance premiums that were established by Law No. 212-FZ, corresponding penalties and fines to pay off arrears on insurance premiums established by the Tax Code of the Russian Federation (letter from the Ministry of Finance of Russia dated 03/01/2017 N 03-02-07/2/11564).

Therefore, with an updated calculation, it is advisable to submit an appropriate application for the return of the amounts of overpaid (collected) insurance premiums. The forms of “pension” applications for return (23-PFR, 24-PFR) are given in Appendices 3 and 4 to the Resolution of the Board of the Pension Fund of December 22, 2015 N 511p, forms of “social insurance” applications (23-FSS RF, 24-FSS RF) - in appendices 3 and 4 to Order of the FSS of Russia dated February 17, 2015 N 49.

The already mentioned letter of the Ministry of Finance of Russia No. 03-02-07/2/11564 states that Laws No. 243-FZ and 250-FZ do not define the powers of the Pension Fund of Russia, the Federal Social Insurance Fund of Russia and tax authorities to make decisions on the offset of amounts overpaid ( collected) insurance premiums for repayment of:

- the amounts of insurance premiums, penalties and fines additionally accrued by the Pension Fund of Russia and the Social Insurance Fund of Russia based on the results of control measures provided for in the aforementioned Article 20 of Law No. 250-FZ and carried out for reporting (calculation) periods that expired before January 1, 2017.

If the payer has arrears in insurance premiums, arrears in payment of the corresponding penalties, fines to extra-budgetary funds that arose for reporting (settlement) periods that expired before January 1, 2017, then both the arrears and the debt are paid by this payer or collected by the tax authority (p 2 Article 4 of Law No. 243-FZ).

Until payment of the specified arrears and debts (or their collection in in the prescribed manner) the territorial branch of the Pension Fund of Russia (territorial branch of the Federal Social Insurance Fund of Russia) has no grounds for returning the amount of overpaid (collected) insurance premiums (corresponding penalties and fines) for reporting (settlement) periods that expired before January 1, 2017.

Therefore, if there is:

- arrears on insurance premiums and debts on corresponding penalties and fines accrued as of January 1, 2017, as well as

- additional accruals of insurance premiums, penalties and fines based on the results of control activities, -

a payer who has amounts of overpaid (excessively collected) insurance premiums must first pay off the specified arrears, debts and additional charges. And only after this, the territorial branches of the Pension Fund (FSS) will be able to make a decision on the return of amounts of overpaid (collected) insurance premiums, penalties and fines.

The decision on refund for reporting (settlement) periods expired before January 1, 2017 must be made by the relevant bodies of the Pension Fund of Russia (FSS) within 10 working days from the date of receipt of the policyholder’s application for refund.

If the payer of insurance premiums submitted an updated calculation of insurance premiums, then 10 days are calculated from the day the territorial branch of the Pension Fund (FSS) completed a desk audit of the specified calculation.

The next day after the decision is made to return the amounts of overpaid (excessively collected) insurance premiums, penalties and fines, the territorial office of the insurer must send it to the appropriate tax authority (clause 4 of Article 21 of Law No. 243-FZ). Refunds of insurance premiums are carried out by the Federal Tax Service, in which the payer of insurance premiums is registered.

Since 2017, the introduced clause 1.1 of Article 78 of the Tax Code of the Russian Federation, which established standards for the offset or return of amounts of overpaid taxes, fees, penalties and fines, allows the amount of overpaid insurance contributions to be offset against the corresponding budget of the state extra-budgetary fund of the Russian Federation, into which this amount was credited to:

- upcoming payments of the payer for this contribution;

- debts on relevant penalties and fines for tax offenses, -

or return them in the manner prescribed by Article 78 of the Tax Code of the Russian Federation.

Consequently, overpaid amounts of insurance premiums for periods starting from the current year can only be offset by type of premium:

- for pension insurance - against upcoming payments of contributions to compulsory pension insurance;

- for health insurance - against upcoming payments for compulsory medical insurance contributions;

- for social insurance - against upcoming payments of contributions to VNiM.

Offsetting the amounts of insurance premiums for one of the types compulsory insurance against insurance premiums for any other type is not possible.

To offset overpaid amounts of insurance premiums, you must contact your Federal Tax Service. The offset is carried out in the same manner as was established for the tax offset (taking into account the specifics of paragraph 1.1 of Article 78 of the Tax Code of the Russian Federation).

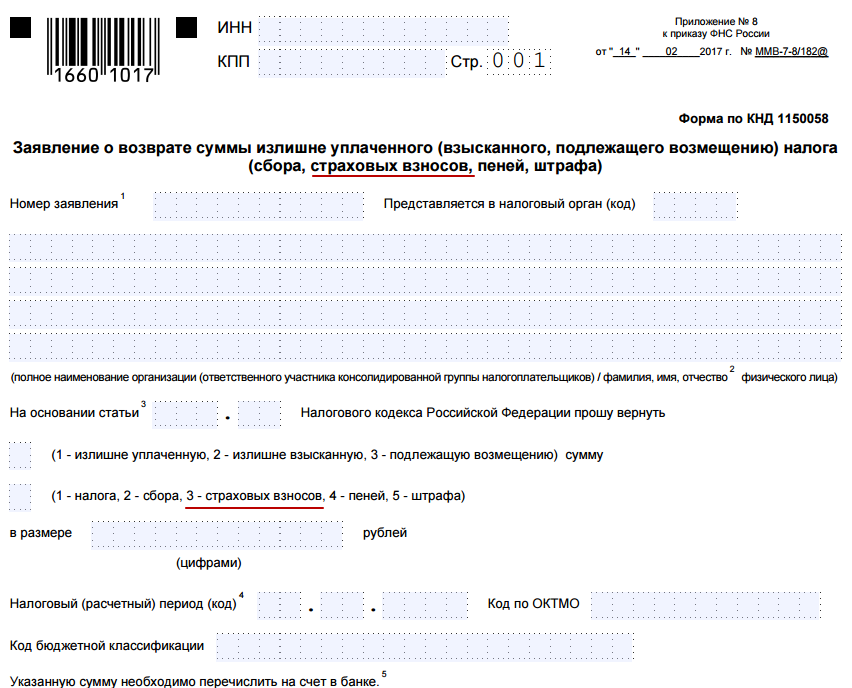

The fact of excessive payment of insurance premiums can be detected both by the payer himself and by the tax authorities. Having identified an overpayment, the tax authority is obliged to notify the policyholder about this within 10 working days (clause 3 of Article 78 of the Tax Code of the Russian Federation). In this case, he uses the form of reporting the fact of excessive payment (excessive collection) of tax (fees, insurance premiums, penalties, fines) (see Appendix 2 to the Order of the Federal Tax Service of Russia dated February 14, 2017 N ММВ-7-8/182@).

The appendices to this Order of the Federal Tax Service of Russia also provide a number of forms that can be used to offset or return overpaid amounts of insurance premiums. For example, application forms for a refund (offset) of the amount of overpaid (collected, subject to reimbursement) tax (fee, insurance premiums, penalties, fines) (see appendices 8, 9).

Tax officials can use forms about offset (Appendix 1), return (Appendix 3), a decision made on offset (refund), refusal to offset (return) the amount of overpaid (collected, subject to reimbursement) tax (fee, insurance contributions, penalties, fines) (Appendix 4).

If facts are discovered indicating a possible excessive payment of insurance premiums, the possibility of conducting a joint reconciliation of calculations for insurance premiums, penalties and fines is not excluded. A proposal to conduct such a reconciliation may come from both the payer of insurance premiums and the tax authority.

The results of the joint reconciliation of calculations for insurance premiums, penalties and fines are formalized in the appropriate act (the form of the act of joint reconciliation of calculations for taxes, fees, insurance premiums, penalties, fines, interest is given in the appendix to the Order of the Federal Tax Service of Russia dated December 16, 2016 N ММВ-7-17 /685@). The act of joint reconciliation of calculations for insurance premiums is handed over to the payer within the next day after the day of its preparation. The act within the same period can be sent by registered mail or transferred to the payer at in electronic format by TKS or via Personal Area taxpayer (subclause 11, clause 1, clause 2.1, article 32 of the Tax Code of the Russian Federation).

Guidelines on maintaining an information resource of the results of work on offsets and refunds (approved by Order of the Federal Tax Service of Russia dated December 25, 2008 N MM-3-1/683@, hereinafter referred to as Methodological Recommendations) are prescribed to the tax authorities before making a decision on the offset (return) of overpaid insurance premiums monitor compliance mandatory conditions established by the Tax Code of the Russian Federation, in particular:

- actual crediting of the amount of overpaid insurance premiums to the budget revenue account of the corresponding extra-budgetary fund;

- absence of debt on penalties and fines of the corresponding type of insurance premiums - upon return of overpaid insurance premiums.

The offset of the amount of overpaid insurance premiums against future payments is carried out only on the basis of an application from the payer. Such an application may be submitted in writing, in electronic form with an enhanced qualified electronic signature via TKS or through your personal account.

The tax authorities must make a decision to offset the amount of overpaid insurance premiums against future payments within 10 days from the date of receipt of the payer’s application or from the date of signing by the tax authority and this payer of a joint reconciliation report of the insurance premiums paid by him, if such a joint reconciliation was carried out.

The offset of the amount of overpaid insurance premiums towards the repayment of debt on penalties and (or) fines subject to payment or collection is carried out by the tax authorities independently. The decision to offset the amount of overpaid insurance premiums is made by the tax authority within 10 days from the date it discovers the fact of such excess payment, or from the date the tax authority and the taxpayer sign a joint reconciliation report of the insurance premiums paid, or from the date the court decision comes into force.

The payer may submit a written application to the tax authority to offset the amount of overpaid insurance premiums against the debt on penalties and fines. In this case, the decision of the tax authority to offset the amount of overpaid tax to pay off arrears and debts is made within 10 days from the date of receipt of the specified application of the payer or from the date of signing by the tax authority and this taxpayer of a joint reconciliation report of the insurance premiums paid by him. The specified application can be sent in electronic form with an enhanced qualified electronic signature via TKS or submitted through your personal account.

Excessively paid insurance premiums can be returned only upon the payer’s application (submitted in writing, in electronic form with an enhanced qualified electronic signature via TKS or through a personal account). The refund must be made within a month from the date the tax authority received the application.

Refunds of overpaid insurance premiums if there are arrears of penalties and fines to be collected are made only after the amount of overpaid insurance premiums is offset against the debt.

Applications for offset or refund of overpaid insurance premiums may be submitted within three years from the date of payment of the premiums.

The decision to return the amount of overpaid insurance premiums is made by the tax authority within 10 days from the date of receipt of the taxpayer’s application for a refund or from the date of signing by the tax authority and the taxpayer of a joint reconciliation report of the insurance premiums paid by him.

The tax authority is obliged to inform the taxpayer about the decision made (on offset (refund) or refusal) within 5 days from the date of adoption of the corresponding decision. The message is transmitted personally against a signature or in another way confirming the fact and date of its receipt.

Interest

Tax officials are obliged to return the overpaid amount of tax within a month from the date of receipt of the application from their payer, and in case of violation of the tax refund deadline, the fiscal authorities must charge interest on the amount of overpaid tax that was not returned within the prescribed period (Clause 10 of Article 78 of the Tax Code of the Russian Federation) . Interest is paid for each calendar day of violation of the repayment deadline, and their amount is determined based on the refinancing rate (key rate) of the Bank of Russia in effect on the days of violation of the repayment deadline.

To calculate the amount of interest payable, the following expression is used (clause 3.2.7 of the Methodological Recommendations):

P = SV: 365 (366) x SR x DPR: 100%,

where P is the amount of interest to be accrued; SV - the amount that is subject to return to the taxpayer's current account; SR - the Bank of Russia rate in effect on the days of the transfer delay; DPR - number of days of delay.

If, before the end of the month, the tax authorities returned part of the overpaid tax, then interest is charged on the balance.

When the Bank of Russia rate changes in certain periods of time, interest is calculated separately for each period of validity of the corresponding rate.

From January 1, 2016, the refinancing rate is equal to the key rate (directive of the Bank of Russia dated December 11, 2015 N 3894-U). The key rate in 2017 is:

- from January 1 to March 26 - 10%;

- from March 27 to May 1 - 9.75%;

- from May 2 - 9.25%.

The rules established by Article 78 of the Tax Code of the Russian Federation, in accordance with paragraph 14 of this article, also apply to the offset or return of amounts of overpaid insurance premiums and apply to payers of insurance premiums. And it is logical to believe that if the tax authorities delay the return of the amount of overpaid insurance premiums, they should be charged interest.

The norm for calculating interest in the event that the refund of overpaid insurance premiums was carried out in violation of the established 30-day period also existed in Law No. 212-FZ (clause 17 of Article 26). The 30-day period was counted from the moment the application was submitted (clause 11, article 26). And it would seem that when transferring amounts of overpaid (excessively collected) insurance premiums that arose for reporting (calculation) periods that expired before January 1, 2017, tax authorities must also charge interest for days of delay. However, the Ministry of Finance of Russia, in letter dated 03/01/2017 N 03-02-07/2/11564, indicated that Law N 250-FZ does not provide for the payment of interest to payers of insurance premiums for violation deadline refund of amounts of overpaid (collected) insurance premiums that were established by Law N 212-FZ, corresponding penalties and fines for reporting (calculation) periods expired before January 1, 2017. Tax officials will most likely follow the recommendations of financiers.

Features of the return of contributions to compulsory pension insurance

Note. The leadership of the Federal Tax Service of Russia, in a letter dated 05/02/2017 N ГД-4-8/8281, proposed the following algorithm of actions to lower tax authorities in the event of transferring to the fiscal authorities incorrect amounts of debt as part of the balance of settlements for insurance premiums for periods expired before January 1, 2017:

- when the payer contacts the tax authority in person or by telephone, he should be advised to contact the relevant body of the Pension Fund of Russia or the Federal Social Insurance Fund of Russia;

- in case of receipt of an official appeal from the payer, the specified appeal should be sent to the appropriate territorial body of the state extra-budgetary fund according to its affiliation.

Clause 6.1 of Article 78 of the Tax Code of the Russian Federation establishes restrictions on the return of overpaid insurance contributions for compulsory pension insurance. Refunds are not allowed if, according to the territorial management body of the Pension Fund of Russia, information on the amount of overpaid insurance contributions for compulsory pension insurance, submitted by the payer of insurance contributions as part of individual (personalized) accounting information, is recorded on the individual personal accounts of insured persons in accordance with legislation of the Russian Federation on individual (personalized) accounting in the compulsory pension insurance system. A similar norm was established by paragraph 22 of Article 26 of Law No. 212-FZ.

The specified norms of Law N 212-FZ and the Tax Code of the Russian Federation refer to the amounts of overpaid insurance premiums, which were indicated in the information submitted by the payer of insurance premiums to the Pension Fund of the Russian Federation as part of the reporting on individual (personalized) accounting.

Insurers-employers submitted reports on individual (personalized) accounting in the RSV-1 calculation of the Pension Fund of Russia. And for the last quarter of 2016, bona fide payers submitted such a calculation in mid-February 2017.

Pension Fund bodies are obliged, in particular, to ensure timely inclusion in the relevant individual personal accounts of insured persons of information provided by tax authorities and policyholders, as well as secure storage of this information (Article 16 of the Federal Law of 01.04.1996 N 27-FZ "On individual personalized accounting in the compulsory pension insurance system"). But the deadline for transferring this information to personal accounts is not established by law.

Paragraph 2 of Article 18 of the Federal Law of December 28, 2013 N 400-FZ “On Insurance Pensions” provides cases when the amount of the insurance pension is recalculated. Among these is an increase, according to individual (personalized) accounting in the compulsory pension insurance system, of the value of the individual pension coefficient based on the amount of insurance contributions for the insurance pension that are not taken into account when determining the value of the individual pension coefficient for calculating the amount of the old-age insurance pension. Such recalculation is made without an application from the pensioner from August 1 of each year.

Consequently, by this day, the personal account of the insured person must take into account the information provided by the policyholders under individual (personalized) accounting. It is unlikely that by the beginning of the second half of the year there will not be a message from the territorial management body of the Pension Fund of the Russian Federation that information on the amount of overpaid insurance contributions for compulsory pension insurance, submitted by the payer of insurance contributions as part of the information on individual (personalized) accounting for last year, are recorded on the individual personal accounts of the insured persons. This means that payers should not expect a refund of overpaid insurance premiums for compulsory pension insurance for periods ending before January 1, 2017.

PBOYULs do not submit reports on individual (personalized) accounting for themselves to the Pension Fund of the Russian Federation.

Clause 9 of Article 14 of Law No. 212-FZ ordered tax authorities to send information on income from the activities of self-employed people to the Pension Fund of Russia individuals- payers of insurance premiums for the billing period no later than June 15 of the year following the expired billing period. This allowed pensioners to determine the amount of insurance premiums that the PBOYUL had to pay for the previous year. The amount of insurance premiums paid by the entrepreneur for OPS, which should have been transferred to his individual card, they could determine in the first half of April from the received payment documents: the deadline for payment of insurance premiums calculated from the amount of income of the insurance premium payer exceeding 300,000 rubles. for the billing period - no later than April 1 of the year following the expired billing period (Clause 2, Article 16 of Law No. 212-FZ).

Information about income from the activities of taxpayers for the billing period was the basis for sending a demand for payment of arrears, as well as for collecting it (clause 11 of Article 14 of Law No. 212-FZ).

All this reduces to zero the likelihood of a refund of overpaid insurance premiums for compulsory pension insurance for 2014 and 2015 by PBOYULs under the general taxation system, whose income during these tax periods exceeded 300,000 rubles.

Policyholders who overpay insurance premiums need to pay attention to the new forms of documents for the return or offset of these amounts, adopted by the Pension Fund of the Russian Federation. These are forms of acts of joint reconciliation of calculations for contributions, penalties and fines; applications for offset (refund) of amounts of overpaid (excessively collected) contributions, penalties and fines; decisions on offset (refund) of amounts of overpaid (collected) contributions, penalties and fines. When studying the nuances of new forms of documents, it is appropriate to recall the features of the procedures for offsets and refunds of overpayments to extra-budgetary funds.

The new forms were approved by resolutions of the PFR Board dated December 22, 2015 No. 511p “On approval of document forms used when the Pension Fund of the Russian Federation offsets or returns amounts of overpaid (collected) insurance contributions” (hereinafter referred to as PFR Resolution No. 511p) and No. 512p “On approval of document forms used when the Pension Fund of the Russian Federation offsets or returns amounts of overpaid (collected) contributions for additional social security” (hereinafter referred to as PFR Resolution No. 512p). Both resolutions were registered with the Ministry of Justice of Russia on January 25, 2016 under numbers 40739 and 40738, respectively.

New forms for returning and crediting overpaid contributions

The Pension Fund of the Russian Federation has changed the type of documents used to return overpaid insurance premiums.

Since February 8, 2016, payers who have overpaid to the Pension Fund of Russia or the Federal Compulsory Medical Insurance Fund use the following updated forms:

Act of joint reconciliation of calculations for insurance premiums, penalties and fines (form 21-PFR);

Application for offset of amounts of overpaid insurance premiums, penalties and fines (Form 22-PFR);

Application for the return of overpaid insurance premiums, penalties and fines (Form 23-PFR);

Application for the return of amounts of excessively collected insurance premiums, penalties and fines (Form 24-PFR).

Forms of decisions on offset (refund) of amounts of overpaid (collected) insurance premiums, penalties and fines are also approved in new editions (Form 25-PFR, Form 26-PFR, Form 27-PFR). The corresponding forms are approved by Resolution No. 511p. At the same time, the document forms approved by orders of the Ministry of Labor of Russia dated December 4, 2013 No. 712n and dated February 17, 2015 No. 95n 1 were declared invalid.

Refund of overpaid amounts in favor of flight crew members

Documents for the return or offset of overpaid amounts for additional social security for aircraft flight crew members have also been updated. civil aviation and certain categories of coal industry workers. Instead of the order of the Ministry of Labor of Russia dated November 21, 2013 No. 692n, the resolution of the Pension Fund Board dated December 22, 2015 No. 512p is in force.

Starting from February, the forms of the following documents will look new:

Act of joint reconciliation of calculations for contributions to additional social security, penalties and fines (Form 21 DSO-PFR);

Application for offset of amounts of overpaid contributions for additional social security, penalties and fines (Form 22 DSO-PFR);

Application for the return of overpaid contributions for additional social security, penalties and fines (Form 23 DSO-PFR);

Application for the return of amounts of excessively collected contributions for additional social security, penalties and fines (Form 24 DSO-PFR);

Decision on offset of amounts of overpaid contributions for additional social security, penalties and fines (Form 25 DSO-PFR);

Decision on the return of amounts of overpaid (collected) contributions for additional social security, penalties and fines (Form 26 DSO-PFR);

Decision on offset of amounts of excessively collected contributions for additional social security, penalties and fines (Form 27 DSO-PFR).

Note!

You can familiarize yourself with the new forms of documents used when the Pension Fund of Russia offsets or returns amounts of overpaid (collected) insurance premiums, as well as contributions for additional social security, on the official website of the Pension Fund of Russia in the “Insured” section.

Let us recall that the forms of documents used when carrying out offsets and refunds of overpayments under the social insurance fund were updated in 2015 by order of the Federal Social Insurance Fund of Russia dated February 17, 2015 No. 49 “On approval of the forms of documents used when carrying out offsets or refunds of amounts overpaid (collected) ) insurance contributions, penalties and fines to the Social Insurance Fund of the Russian Federation" (hereinafter - Order of the Federal Social Insurance Fund of Russia No. 49). This document was last amended on July 20, 2015.

Overpayment: reasons for education, types of credit and other issues

Overpayment of insurance premiums may result from various reasons. Quite often this is a consequence of the fact that the payment order indicated an incorrect BCC or the taxable base was incorrectly determined. In some cases, amounts may be unreasonably collected from the payer by the control body.

Depending on the reason why the payer overpaid, the law establishes two different procedures:

Set-off (refund) of overpaid amounts;

Refund of overcharged amounts.

Art. 26 of the Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund” (hereinafter referred to as Law No. 212-FZ).

Where can I go to claim an overpayment of insurance premiums?

The payment of three types of insurance premiums is controlled by two departments - the Pension Fund of the Russian Federation and the Federal Insurance Fund of Russia (Part 1, Article 3 of Law No. 212-FZ).

Depending on what type of contribution the overpayment occurred, you must contact the territorial body of a particular department (see table).

Table. Where to go to offset overpayments on insurance premiums

To offset the overpayment of insurance premiums, an organization or individual entrepreneur must submit a special application. The application must be submitted in the prescribed form. Failure to comply with the application form is grounds for a decision to refuse credit (refund).

Thus, when applying to the Pension Fund of the Russian Federation, it is necessary to use an application in the form approved by the Pension Fund of Russia Resolution No. 511p, when applying to the Social Insurance Fund - by order of the Federal Social Insurance Fund of Russia No. 49.

Types of offset of overpayment

The procedure for conducting the test is established in Art. 26 of Law No. 212-FZ. This article establishes the following types of overpayment offset:

For future payments;

To pay off debts on insurance premiums, penalties or fines.

The use of each type depends on some nuances. In particular, on the state of settlements with extra-budgetary funds for all insurance premiums, namely the presence of debt on penalties and fines.

Account with one administrator

Let us recall that previously it was possible to carry out offsets only within the framework of one extra-budgetary fund (Part 21, Article 26 of Law No. 212-FZ). This meant that if the payer had an overpayment to the Pension Fund budget, then he could offset it against upcoming payments of pension contributions to the Pension Fund budget or to pay off debts on penalties and fines to the Pension Fund budget. It was impossible to count the overpayment towards repayment of debt to the Federal Compulsory Medical Insurance Fund.

From January 1, 2015, payers were able to take into account overpaid amounts of insurance premiums between different types contributions administered by one fund. According to Law No. 212-FZ, the overpaid amount can be offset against upcoming payments or used to pay off debts, penalties and fines.

Deadline for submitting an application

An organization (entrepreneur) has the right to submit an application to the fund to offset the overpayment of insurance premiums within three years from the date of payment of the excess amount. This is stated in Part 13 of Art. 26 of Law No. 212-FZ. It is necessary to start from the date when the excess contributions were actually paid.

Overpayment offset mechanism

Please note that the mechanism for offsetting overpayments on contributions depends on who discovered the overpayment:

The payer himself;

Specialists from the Pension Fund of Russia or the Federal Insurance Service of Russia.

The policyholder may discover an overpayment by conducting a background check accounting. It is reflected in the form of the final balance in the debit of account 69 “Calculations for social insurance and security” for the corresponding subaccount.

The company can either offset the overpayment against future payments or use it to pay off debt on insurance premiums. Reconciliation of settlements with the relevant fund (Part 4, Article 26 of Law No. 212-FZ) will help you decide on the best course of action. Reconciliation will give an objective picture of the state of settlements.

If the payer does not offer to carry out a reconciliation, but immediately writes an application for offset of insurance premiums, most likely, the reconciliation will be initiated by fund specialists (Part 4 of Article 26 of Law No. 212-FZ) to ensure the validity of the requirements. If the reconciliation of calculations has confirmed the presence of an overpayment, the fund’s specialists have the right to independently (without the payer’s application) carry out an offset (Parts 6 and 8 of Article 26 of Law No. 212-FZ) against:

Future payments;

Repayment of debt on insurance premiums, penalties or fines.

At the same time, the payer can choose the type of offset and indicate it in his application (Parts 6 and 10 of Article 26 of Law No. 212-FZ), without relying on funds. This makes it possible to independently control the process.

If an overpayment is discovered by employees of the Pension Fund of Russia or the Federal Social Insurance Fund of Russia, then within ten working days they must notify the payer in writing (Part 3 of Article 26 of Law No. 212-FZ). If fund specialists plan to conduct a joint reconciliation of calculations, they will indicate this in the notice of overpayment. After this, a joint reconciliation of calculations for insurance premiums can be carried out (Part 4 of Article 26 of Law No. 212-FZ). Its results are documented in an act. If the company is checking with the Pension Fund, an act will be drawn up in Form 21-PFR, if with social insurance - Form 21-FSS of the Russian Federation.

The calculation of the deadlines for offset of contributions depends on the date of signing the reconciliation act.

However, reconciliation may not be carried out. As a rule, this is done if the policyholder has no debt on insurance premiums, penalties and fines. In this case, the period for making a decision on offset is calculated from the date of discovery of the fact of excessive payment (or from the date of receipt of the application for offset of contributions).

Fund specialists can carry out the offset themselves (Part 6, Article 26 of Law No. 212-FZ). Moreover, if the company has debt on this species insurance premiums (for example, there is an overpayment of contributions to the FFOMS, but there is an arrear of penalties to the same fund), first the overpayment will be sent to repay it (Part 8 of Article 26 of Law No. 212-FZ). The remaining amount will be applied towards future payments. However, in this case, to be on the safe side, the organization can write a corresponding statement.

The offset of overpayments on insurance premiums is not reflected in accounting by additional entries. It is taken into account when subsequently paying insurance premiums.

Regardless of who discovered the overpayment, the decision to offset it is made by the head of the territorial body of the fund or his deputy. The decision to offset the overpayment against future payments must be made within ten working days from the date (Part 6 of Article 4 and Part 7 of Article 26 of Law No. 212-FZ):

Detection of the fact of excessive payment;

Receiving an application from the policyholder to offset the overpayment;

Signing the reconciliation report, if it was carried out.

The forms of decisions No. 25-PFR and 25-FSS of the Russian Federation (depending on the agency carrying out the offset) were approved respectively by Resolution of the Board of the Pension Fund of the Russian Federation No. 511 and Order of the FSS of Russia No. 49.

Fund employees make a decision to offset the overpayment to pay off debts on penalties or fines within the same period. This is what it says in parts 9 and 10 of Art. 26 of Law No. 212-FZ.

Fund employees must inform the payer about offset or refusal to offset within five working days from the date of the decision (Part 6, Article 4 and Part 16, Article 26 of Law No. 212-FZ). The notice is given to a company representative against signature or sent by registered mail. In the latter case, it will be considered that the document was received six working days after sending (Part 16, Article 26 of Law No. 212-FZ).

Important!

A refund of the amount of overpaid insurance contributions to the Pension Fund is not made if the territorial body of the Pension Fund took into account the amount of overpaid insurance contributions as part of the personalized accounting information and this information was posted by the Fund to the individual personal accounts of the insured persons.

Refund of overpayment

To return overpaid money to the current account, the payer must submit an application. The deadline for filing a refund application is the same as for credit (three years).

Arbitrage practice

By general rule The deadline for filing a refund application begins to be calculated from the date of payment of contributions.

At the same time, back in 2006, the Supreme Arbitration Court of the Russian Federation, considering a case based on a taxpayer’s application on the application of Art. 79 of the Tax Code of the Russian Federation, which similarly determines the deadline for filing an application for a tax refund, formulated the following legal position. The question of the procedure for calculating the deadline for a taxpayer to submit an application to the court for the refund of overpaid tax must be resolved taking into account the fact that the application must be filed within three years from the day the taxpayer learned or should have learned about the fact of the overpayment (resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 08.11 .2006 No. 6219/06).

It is with this legal position in mind that the courts consider applications from payers when appealing decisions to refuse a refund due to missing a three-year deadline. Most of these cases are resolved in favor of the payers.

Thus, in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated April 13, 2010 No. 17372/09, it is noted that the moment when the payer learned or should have learned about the fact of excessive payment is subject to determination taking into account an assessment of the totality of all circumstances relevant to the case.

In particular, the courts must consider and evaluate the reasons why the payer overpaid, whether he has the opportunity to correctly calculate according to the initial declaration, and changes in current legislation during the tax period in question. During the consideration of the court case, other circumstances may be established that may be recognized by the court as sufficient to recognize the deadline for tax refund as missed.

For example, if an overpayment for 2012 arose after the submission of an updated calculation for the specified period in 2014, the three-year period must be calculated not from the date of actual payment, but from the date of occurrence and identification of the overpayment (Resolution of the Federal Antimonopoly Service of the North Caucasus District dated February 28, 2014 No. F08-178/14, Moscow District dated January 28, 2014 No. F05-16441/13, Volga-Vyatka District dated January 22, 2014 No. F01-12909/13).

If the overpayment is revealed as a result of an on-site audit conducted by the fund, in this case the courts will also recognize as unlawful the refusal to return the overcharged amount due to the missed period of three years from the date of payment.

For example, Supreme Court The Russian Federation indicated: in satisfying the demands of the society, the court must proceed from the fact that the fact of excessive payment of insurance premiums became known to the society upon receipt of the on-site tax audit report. Consequently, the three-year period is subject to calculation precisely from this date, and not from the date of actual payment of the specified amount (Determination of the Armed Forces of the Russian Federation dated 01.02.2016 No. 310-KG15-18672).

In some cases, courts recognize that the moment from which the payer learned about the existence of an overpayment is the date of entry into legal force court decisions (see, for example, decisions of the Federal Antimonopoly Service of the North-Western District dated 04/17/2014 in case No. A26-5861/201, Moscow District dated 07/11/2014 No. F05-7022/2014).

When considering an application for the return of overpaid amounts, as in the case of offset, the fund will definitely check whether there is arrears of penalties and fines. If so, the overpayment will be used first to pay off such debts. And they will return everything that remains.

It should be noted that in practice, pension fund authorities may refuse to return an overpayment to one fund (for example, a pension) if there is a debt to another fund (FFOMS). This situation became the subject of legal proceedings. The courts, recognizing the rightness of the payer, indicated that “in order to return to the payer overpaid amounts of insurance premiums to a specific fund, it is necessary to have an overpaid amount of insurance premiums, the absence of arrears of penalties and fines due to the same fund, the presence of an application from the payer of insurance premiums for a refund in accordance with in the established form and compliance with the deadline for its submission. The presence of arrears in insurance premiums payable to the Pension Fund of the Russian Federation does not indicate the absence of grounds for the return of overpaid insurance premiums for compulsory health insurance, since the overpayment was generated by another fund" (Resolution of the AS of the Ural District dated April 22, 2015 No. F09-2190/15) .

Conducting a reconciliation when the fund considers a return application is also possible, although it is not mandatory.

Making a decision to return the overpayment

The decision on return is made within ten working days from the date of receipt of the application or signing of the reconciliation report (if any). By analogy with a set-off, the fund must report the decision within five working days.

There is a strict deadline for refunding overpayments. It is one month from the date of receipt of the application (signing of the reconciliation report). If the money is not returned to statutory term, the payer is entitled to interest. They are counted for each calendar day of delay. To calculate interest, you need to multiply the amount of overpayment by 1/300 of the current refinancing rate of the Bank of Russia. This will be one day's interest. Next, the resulting number is multiplied by the number of days of delay. Interest is calculated and paid on the day of actual return of funds to the payer. To this end, the treasury, which actually credits the money to the payer's account, must notify the fund of the date and amount of the return. If necessary, the fund must send an order to the Treasury to additionally pay the missing amount of interest. Fund specialists must do this within three working days from the date of receipt of the notification of return.

Refund of overcharged amounts

It is impossible not to mention excessively collected fees.

As a rule, overcharges are illegally collected money from the payer. Therefore, in this case, Law No. 212-FZ establishes fundamentally different rules. Illegally collected amounts are subject to refund. Moreover, for the entire period that the money is in the fund’s budget, the payer is entitled to interest from the date of collection to the day of actual return.

You must actively exercise your right to return overcharged amounts. To obtain a refund, the fee payer must take the initiative by submitting a written application in the prescribed form to the control body. In this case, the application must indicate your right to receive interest.

Judicial practice in these cases is, of course, on the side of payers (see, for example, the rulings of the Supreme Court of the Russian Federation dated February 17, 2016 No. 309-KG15-19788, the Supreme Arbitration Court of the Russian Federation dated February 13, 2014 No. VAS-287/14). At the same time, when calculating interest, the courts indicate that for the day the funds are credited to the payer’s account, the latter is also entitled to interest (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 24, 2013 No. 11675/13).

An application for the return of an excessively collected amount can be submitted to the territorial body of an extra-budgetary fund within a month from the day you learned about the excessive collection. Application forms are available in PFR Resolution No. 511p.

If you miss the monthly deadline, you will be able to return the overcharged contributions only through the court. The company can file a claim within three years. Moreover, in this case, the three-year period is calculated from the moment when the payer learned or should have learned about the fact of excessive collection. This moment does not always coincide with the day of actual payment.

The fund must make a decision on the return within ten working days from the date of receipt of the application.

1 See order of the Ministry of Labor of Russia dated December 22, 2015 No. 1109n “On invalidating certain orders of the Ministry of Labor and Social Protection of the Russian Federation.”

Some policyholders have already overpaid insurance premiums in 2017, while others still have an old one. What can you do? We talk about the rules that are in force in 2017 after the transfer of the administration of insurance premiums to the tax department.

Where to contact

To make a refund of overpayment of insurance premiums, in 2017 you need to contact not the Pension Fund or the Social Insurance Fund, but the tax inspectorates(Article 78 of the Tax Code of the Russian Federation).

At the same time, if you are counting on a refund of the overpayment of insurance premiums to the Social Insurance Fund in 2017 (for injuries), then you must still contact the branch of this fund. The algorithm for returning and offsetting overpayments for this type of contribution is described in Article 26.12 of the Law of July 24, 1998 No. 125-FZ “On Mandatory social insurance from accidents at work and occupational diseases."

It is necessary to contact the Pension Fund and the Social Insurance Fund if there is an overpayment of insurance premiums for periods before 01/01/2017. It can only be returned. This does not apply to contributions for injuries, for the return or offset of which you must still apply to the Social Insurance Fund.

There is no need to wonder whether an overpayment of insurance premiums can be offset against injuries. The FSS will do this itself.

Order

The question of how to return overpayments on insurance premiums should not cause any difficulties: the return algorithm is the same as for taxes.

However, keep in mind that it will not be possible to refund the overpayment of Pension Fund insurance premiums if the received amounts have already been posted by the Pension Fund to the personal accounts of the insured persons in the compulsory insurance system (new clause 6.1 of Article 78 of the Tax Code of the Russian Federation).

As before, as a general rule, the overpayment of insurance premiums in 2017 is offset against the corresponding fund budget against future deductions of this contribution, as well as debts for the corresponding penalties and fines for tax offenses.

Many people are interested in how to offset overpayments on insurance premiums of one type against others. But no way. The law does not allow this. Therefore, strictly by type: pension - to pension, medical - to contributions to compulsory medical insurance, and so on.

Also, the legislation does not provide for how to offset the overpayment of insurance premiums in 2017, which was formed before 01/01/2017. There is no such mechanism. It can only be returned.

New application forms

To return the money, you must send an application letter to the inspectorate for a refund of the overpayment of insurance premiums (Clause 6, Article 78 of the Tax Code of the Russian Federation). It can be done:

- in paper form;

- electronically via TKS with an enhanced qualified signature;

- through your personal account on the official website of the Federal Tax Service of Russia www.nalog.ru.

To fulfill an application for a refund of overpayment of contributions, the law gives tax authorities exactly 1 month from the date of receipt.

By the way, from March 31, 2017, the new form applications for refund of overpayment of insurance premiums. It was approved by order of the Russian Tax Service dated February 14, 2017 No. ММВ-7-8/182.

Please note that to offset the overpayment of insurance premiums, you must also use a new form, which was approved by the same order of the Federal Tax Service:

Note that, compared to the previous ones, the new forms of applications for credit and refund now resemble a machine-readable tax return. So, it looks like the fields are designed, and there are barcodes at the top of the pages. The number of pages has been increased from one to three.

Old debts

The Pension Fund took care of those who overpaid insurance contributions to the Pension Fund for periods before 2017. He advises submitting an application using the following form:

If you find an error, please highlight a piece of text and click Ctrl+Enter.