In accordance with Part 12 of Article 2 of the Federal Law of July 19, 2011 N 247-FZ “On social guarantees for employees of internal affairs bodies of the Russian Federation and amendments to certain legislative acts of the Russian Federation” 1 - I order:

1. Approve the attached Procedure for paying bonuses for conscientious performance of official duties to employees of the internal affairs bodies of the Russian Federation.

2. Clauses 33 - 42 of the Regulations on monetary compensation for employees of internal affairs bodies of the Russian Federation, approved by order of the Ministry of Internal Affairs of Russia dated December 14, 2009 N 960 2, are declared invalid.

4. Control over the implementation of this order is assigned to the Deputy Ministers, who are responsible for the relevant areas of activity.

Minister General of the Army R. Nurgaliev

_________________

1 Collection of Legislation of the Russian Federation, 2011, No. 30 (Part I), Art. 4595; N 46, art. 6407; Russian newspaper, 2011, December 7.

2 Registered with the Russian Ministry of Justice

February 12, 2010, registration N 16404, taking into account changes made by orders of the Ministry of Internal Affairs of Russia dated January 12, 2011 N 8 (registered with the Ministry of Justice of Russia

February 8, 2011, registration N 19738) and dated August 1, 2011 N 898 (registered with the Ministry of Justice of Russia on October 28, 2011, registration N 22165).

Application

The procedure for paying bonuses for conscientious performance of official duties to employees of internal affairs bodies of the Russian Federation

1. Employees of the internal affairs bodies of the Russian Federation 1 are paid bonuses for conscientious performance of official duties 2 at the rate of three salaries per year.

2. The bonus is paid monthly at the rate of twenty-five percent of the salary established for the employee on the 1st day of the month in which the payment is made.

3. The bonus is calculated in proportion to the time the employee performs his official duties in the corresponding calendar month. The calculation period for payment of the bonus includes the time of training, being on vacation with the same pay, and releasing the employee from official duties due to temporary disability.

4. The amount of the bonus for each calendar day of service is calculated by dividing the full amount of the bonus for the month, determined in accordance with paragraph 2 of this Procedure, by the number of calendar days in this month.

5. To employees placed at the disposal of the federal executive body in the field of internal affairs, its territorial body or subdivision, bonuses may be paid on the basis of an order from the head of the said body, subdivision, taking into account the actual volume of official duties performed by them within the limits of twenty-five percent of the salary. .

6. When an employee moves within a month, the bonus is paid to him at the new place of duty in the amount determined in accordance with paragraph 2 of this Procedure.

7. The bonus is not paid to employees:

a) who is on parental leave until the child reaches the age of 3 years;

b) temporarily suspended from performing official duties on one of the grounds provided for by Federal Law No. 342-FZ of November 30, 2011 “On service in the internal affairs bodies of the Russian Federation and amendments to certain legislative acts of the Russian Federation” 3.

8. Employees dismissed from service in internal affairs bodies are not paid a bonus in the month of dismissal if the dismissal was made on the following grounds:

a) gross violation of official discipline;

b) repeated violation of official discipline if the employee has a disciplinary sanction imposed in writing by order of the head of the federal executive body in the field of internal affairs or an authorized manager;

c) refusal of an employee to be transferred to a lower position in internal affairs bodies in order to execute a disciplinary sanction;

d) violation of the terms of the contract by the employee;

e) failure by an employee to comply with restrictions and prohibitions established by federal laws;

f) loss of trust;

g) submission by an employee of forged documents or knowingly false information when entering service in the internal affairs bodies, as well as submission by an employee during the period of service in the internal affairs bodies of forged documents or knowingly false information confirming his compliance with the requirements of the legislation of the Russian Federation in terms of conditions filling the corresponding position in the internal affairs bodies, if this does not entail criminal liability;

h) conviction of an employee for a crime, as well as termination of criminal prosecution against the employee due to the expiration of the statute of limitations, in connection with the reconciliation of the parties, as a result of an amnesty act, in connection with active repentance;

i) committing an offense that discredits the honor of an employee of internal affairs bodies;

j) violation by an employee of mandatory rules when concluding a contract.

9. Within the limits of funds for the payment of salary, one-time bonuses may be additionally paid to employees who successfully perform particularly complex and important tasks.

10. The decision to pay a one-time bonus specified in paragraph 9 of this Procedure is formalized by order of the head of the internal affairs body, organization or unit created to perform the tasks and exercise the powers assigned to the Ministry of Internal Affairs of Russia.

11. In relation to the heads of internal affairs bodies, organizations or divisions created to perform the tasks and exercise powers assigned to the Ministry of Internal Affairs of Russia, and their deputies, the decision on the payment of a one-time bonus is made by a superior manager.

To the Ulan-Ude Garrison Military Court

Administrative plaintiff: Ivanov Ivan Ivanovich

Date and place of birth. Address of place of residence or location (in full). Phone numbers, fax numbers, email addresses. mail.

Administrative respondent: The official whose actions are being appealed:

Commander of military unit 00000

Address: ___________________________

Administrative claim

on challenging the actions of officials related to the non-payment of bonuses for the conscientious and effective performance of official duties for the period from___________ to _____________

I________________________________________________ am doing military service

(military rank, full name)

under contract in military unit No. __________.

In accordance with the Federal Law of the Russian Federation “On monetary allowances for military personnel” and Decree of the Government of the Russian Federation of December 5, 2011 No. 993 “On the payment of bonuses to military personnel for the conscientious and effective performance of official duties and annual financial assistance,” I am entitled to a monthly payment of a bonus for conscientious and effective performance of official duties.

However, the said bonus for the period from _______ to _______ was not paid to me. At the same time, I did not have any disciplinary sanctions or other omissions from my service.

I believe that the actions of officials - the Commander of the Eastern Military District and the commander of military unit No. ___________ related to the failure to pay me a bonus for the conscientious and effective performance of official duties for the period from ______ to ______ violate my rights and are therefore unlawful.

(The following is information about whether a complaint was submitted to a higher authority in the order of subordination or to a person higher in the order of subordination on the same subject specified in the administrative statement of claim filed. If such a complaint was filed, the date of its filing and the result of its consideration are indicated.

Information about the impossibility of attaching to the administrative statement of claim any documents specified in Part 1 of Art. 126 CAS RF, namely:

Notices of delivery or other documents confirming delivery to other persons participating in the case, sent in accordance with Part 7 of Art. 125 CAS RF copies of the administrative statement of claim and documents attached to it, which they do not have;

Documents confirming the payment of the state duty in the prescribed manner and amount, or the right to receive a benefit in the payment of the state duty, or a request for a deferment, installment plan, or a reduction in the amount of the state duty, with the attachment of documents indicating the existence of grounds for this;

Documents confirming the circumstances on which the administrative plaintiff bases his claims;

Powers of attorney or other documents certifying the powers of the representative of the administrative plaintiff, documents confirming that the representative has a higher legal education, if the administrative claim was filed by the representative;

Documents containing information about the complaint filed in the order of subordination and the results of its consideration, provided that such a complaint was filed.)

1. Recognize the actions of the Commander of the Eastern Military District and the commander of military unit No. __________ related to the failure to pay me a monthly bonus for the conscientious and effective performance of official duties for the period from ______ to ______ as unlawful.

2. Oblige the Commander of the Eastern Military District to issue an order to pay me a monthly bonus for the conscientious and effective performance of official duties for the period from ____________ to _____________

3. Collect from ________________________________________________________________

(indicate the name of the body paying the salary)

in my favor, legal costs associated with the payment of state fees in the amount of ___________________________________________________________________.

Applications:

1. Copies of the administrative statement of claim and documents attached to it according to the number of persons participating in the case (if there is no notice or other document confirming their delivery to these persons).

2. A document confirming payment of the state duty or the right to receive benefits for its payment, or which is the basis for deferment, installment payment of the state duty or reduction in its amount.

4. Other documents confirming the circumstances on which the administrative plaintiff bases his claims regarding the number of persons participating in the case (if there is no notice or other document confirming their delivery to these persons).

5. A power of attorney or other document certifying the powers of the representative of the administrative plaintiff, a document confirming that the representative has a higher legal education, if the administrative claim was filed by the representative.

"__"_______20__year __________ ____________________

(signature) (signature decryption)

Types of employee bonusesdetermined by the employer or the provisions of local acts, collective agreements, and agreements. In the article we will analyze the issues of bonuses for employees, highlight the main types of bonuses, and talk about the procedure for securing incentive payments.

What types of bonuses are there for employees - the main classifications of types of bonuses and their differences

The current legislation does not establish types of bonuses. In Art. 191 of the Labor Code of the Russian Federation states that bonuses are incentive payments for conscientious performance of duties. In practice, organizations pay various types of bonuses, which can be classified:

By the number of employees awarded:

- Individual awards. Paid to a specific employee.

- Collective awards. Paid to a group of employees. They can work in the same department or division. As a rule, bonuses are paid when joint results are achieved in work activities, for example, the fulfillment of certain indicators.

In order to determine the amount of payments:

- In a fixed amount of money.

- As a percentage of salary.

- In shares of salary.

- As a percentage or fraction of the total salary (for example, from salary + bonus for length of service, etc.).

According to the frequency of accrual.

- One-time.

- Systematic. They can be paid once a month, once a quarter, semi-annually or annually.

Based on the basis for calculation.

- For good work.

- For fulfilling the plan.

- For any other employee achievements.

According to the method of consolidation in the organization:

- Enshrined in employment contracts.

- Collective agreements.

- Local acts.

- Agreements.

- Not fixed in internal documents, paid at the initiative of the manager (these bonuses are not provided for in the remuneration system).

Bonuses based on work results for a month, quarter, year, as the main types of bonuses for employees

In each organization, bonuses can be differentiated according to the frequency of their payments. Bonuses for a month, quarter and year are characterized by the fact that they, as a rule, are of a regular nature, although the possibility of a one-time, one-time accrual is not excluded.

All types of bonuses under consideration can be established by internal regulations of the organization, or paid at the will of the employer. It is possible that such bonuses may be paid based on the provisions of the employment contract with a specific employee. Payment is made based on the employer's order.

Premiums can be paid either with or without grounds.

Award for a particularly important task and its completion

The procedure for bonuses for completing particularly important tasks can be fixed at the organizational level, for example, in the Regulations on Bonuses. It specifies the criteria for paying bonuses, their size, frequency of accrual, etc.

The criteria for payments may be as follows:

- The employee achieved a positive result in completing the task assigned to him or a responsible assignment.

- The employee performed the duties assigned to him by the job description in a quality and timely manner.

- The worker has achieved significant indicators in his work activity, used new work methods, etc.

The payment is made on the basis of an order from the employer or another person whom the manager has authorized to perform such actions. The amount of payments can be determined both by the employer and by the provisions of the internal regulations of the organization.

Most often, the type of bonus under consideration is made on the basis of a memo from the immediate supervisor of the distinguished employee.

Bonus for increasing the volume of work

If an employee is assigned to perform additional work in his profession or in another similar profession (Article 60.2 of the Labor Code of the Russian Federation), a bonus may be provided for this. This is reasonable since the amount of work increases significantly.

Bonuses for increasing the volume of work can be paid based on:

- Provisions of internal documents adopted by the organization.

- A memo from the employee's immediate supervisor.

- Employee statements.

- At the will of the employer.

An employee is involved in additional work only with his consent. It is illegal to force an employee to work for an absent employee.

Award for conscientious performance of official duties

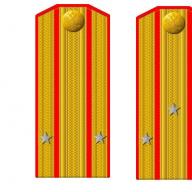

This type of bonus is paid to military personnel and is enshrined in the Rules approved by the Decree of the Government of the Russian Federation “On the payment of bonuses to military personnel...” dated December 5, 2011 No. 993.

The maximum amount is 3 salaries per year. It is permissible to pay bonuses both monthly and quarterly, along with cash allowance. The size of the bonus is determined depending on the military salary. The size of the bonus and the procedure for calculating it depend on the troops in which the serviceman serves.

Award for conscientious work

This type of bonus is fixed in the internal acts of organizations, or is paid at the will of management. Integrity of work involves both a time criterion (an employee’s work in the organization for a long time) and a quality criterion (work done in accordance with the company’s requirements, the absence of disciplinary sanctions).

The criteria can be clearly stated in the Regulations on bonuses. For example, it may be stipulated that bonuses are awarded on this basis to employees with whom at least 3 years have passed since the conclusion of the employment contract and who have not had disciplinary or other sanctions. Payment of the bonus is made on the basis of an order from the head of the organization or a person authorized by him.

Employee bonus for good work (payment of bonus for excellent work)

Good (excellent) work is too vague a criterion for awarding bonuses to an employee. In this regard, organizations adopt local acts or collective agreements in which the term “good” or “excellent” work is specified and clarifying conditions are prescribed, in the presence of which bonuses are awarded to employees.

Good work can be characterized by such criteria as:

- Quantity and quality of products produced or services provided.

- Compliance by the employee with the job description and the provisions of the employment contract.

- Compliance by the employee with internal labor regulations and the absence of disciplinary sanctions.

- Any other indicators that can be attributed to the employee’s labor function.

Thus, the types of bonuses for employees may be different, depending on the place of service and the criteria for calculating bonuses. The possibility of paying several bonuses for various reasons cannot be ruled out.

Read even more useful information in the section: ““.

| Whether or not this publication is taken into account in the RSCI. Some categories of publications (for example, articles in abstract, popular science, information journals) can be posted on the website platform, but are not taken into account in the RSCI. Also, articles in journals and collections excluded from the RSCI for violation of scientific and publishing ethics are not taken into account."> Included in the RSCI ®: yes | The number of citations of this publication from publications included in the RSCI. The publication itself may not be included in the RSCI. For collections of articles and books indexed in the RSCI at the level of individual chapters, the total number of citations of all articles (chapters) and the collection (book) as a whole is indicated."> Citations in the RSCI ®: 0 |

| Whether or not this publication is included in the core of the RSCI. The RSCI core includes all articles published in journals indexed in the Web of Science Core Collection, Scopus or Russian Science Citation Index (RSCI) databases."> Included in the RSCI core: No | The number of citations of this publication from publications included in the RSCI core. The publication itself may not be included in the core of the RSCI. For collections of articles and books indexed in the RSCI at the level of individual chapters, the total number of citations of all articles (chapters) and the collection (book) as a whole is indicated."> Citations from the RSCI ® core: 0 |

| Journal-normalized citation rate is calculated by dividing the number of citations received by a given article by the average number of citations received by articles of the same type in the same journal published in the same year. Shows how much the level of this article is above or below the average level of articles in the journal in which it was published. Calculated if the RSCI for a journal has a complete set of issues for a given year. For articles of the current year, the indicator is not calculated."> Normal citation rate for the journal: 0 | Five-year impact factor of the journal in which the article was published, for 2018."> Impact factor of the journal in the RSCI: |

| Citation normalized by subject area is calculated by dividing the number of citations received by a given publication by the average number of citations received by publications of the same type in the same subject area published in the same year. Shows how much the level of a given publication is higher or lower than the average level of other publications in the same field of science. For publications of the current year, the indicator is not calculated."> Normal citations by area: 0 |